US Treasury Delivers Crypto Framework to Biden as Directed in Executive Order – A fact sheet titled “Framework for International Engagement on Digital Assets” was published by the U.S. Department of the Treasury on Thursday.

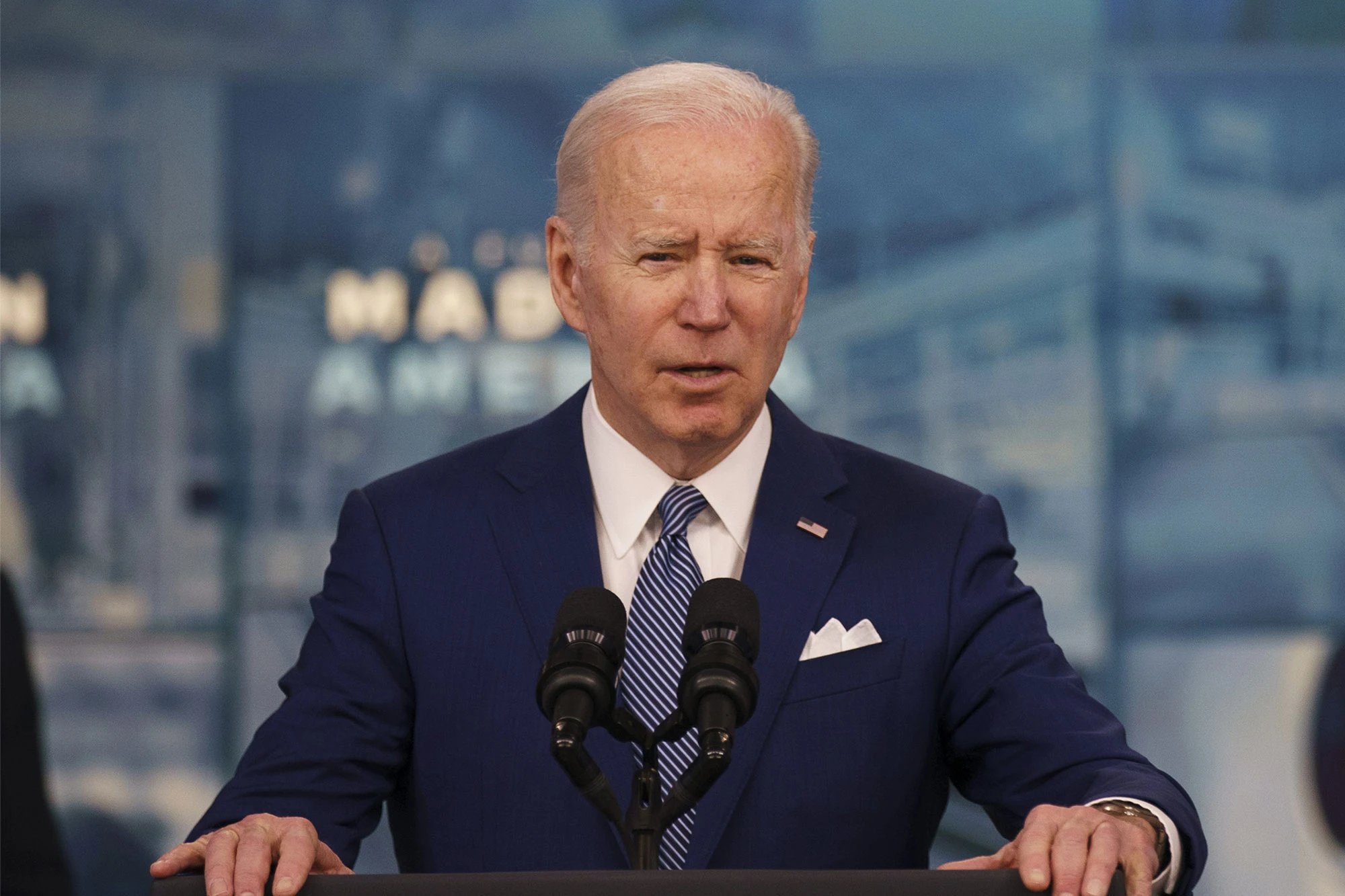

The President’s executive order on ensuring responsible development of digital assets directs the Secretary of the Treasury to present to President Joe Biden “a framework for interagency engagement with foreign counterparts and in international fora.”

On March 9, Biden issued an executive order regulating cryptocurrency. According to the framework, the United States and its partners abroad must work together to develop global standards for the regulation of cryptoassets.

According to the Treasury:

“Arbitrage opportunities are made possible by uneven regulation, supervision, and compliance between jurisdictions, which also increases risks to financial stability as well as the protection of investors, consumers, businesses, and markets.”

People Also Read: Coinbase Responds to Reports of Selling Customer Geo Tracking Data to US Government

The department added that the investigation of illicit digital asset transaction flows that frequently cross international borders, such as in ransomware payments and other cybercrime-related money laundering, is hampered by inadequate anti-money laundering and combating the financing of terrorism (AML/CFT) regulation, supervision, and enforcement by other countries.

The Treasury went on to say that the United States must collaborate with other jurisdictions and take the lead in discussions around digital payment architectures and central bank digital currencies (CBDCs).

The Treasury noted that such international efforts “should continue to address the full range of issues and challenges raised by digital assets, including financial stability; consumer and investor protection; business risks; as well as money laundering, terrorist financing, proliferation financing, sanctions evasion, and other illicit activities.”

Key international engagements for the United States are listed in the fact sheet, including those with the G7 and G20 nations, the Egmont Group of Financial Intelligence Units (FIUs), the Financial Stability Board (FSB), the Financial Action Task Force (FATF), the International Monetary Fund (IMF), the Organization for Economic Cooperation and Development (OECD), The World Bank, and other Multilateral Development Banks (MDBs).

People Also Read: Proposal to Set Up Russian Crypto Exchange Circulated in Moscow

The framework’s goals are to ensure that America’s crucial democratic values are maintained, that consumers, investors, and businesses are protected, that appropriate global financial system connectivity and platform as well as architecture interoperability are preserved, and that the safety and soundness of the international monetary system and the global financial system are maintained, according to the Treasury.