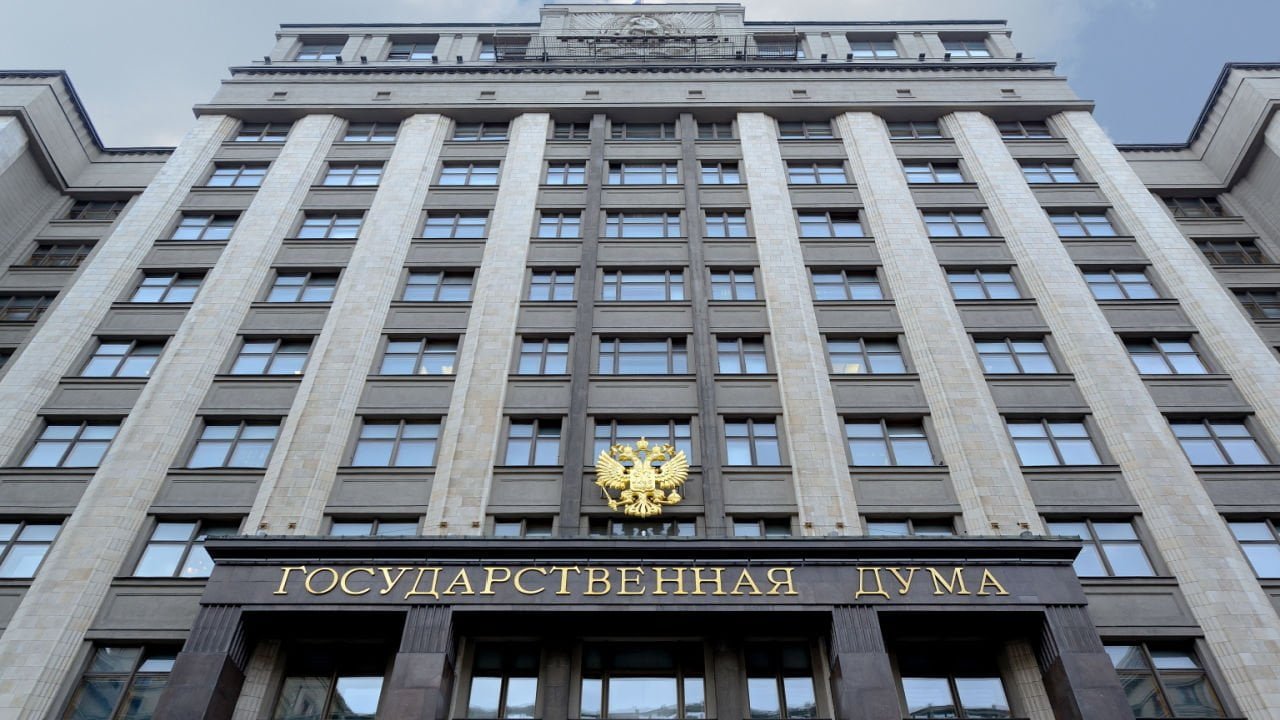

Bill on Digital Ruble Submitted to Russian Parliament – A group of Russian lawmakers, led by the chairman of the Financial Market Committee, Anatoly Aksakov, have produced a draft of legislation regarding the digital ruble, the central bank digital currency (CBDC) issued by the country’s monetary authority. The document proposes legislative changes designed to pave the way for its introduction.

According to the bill’s explanatory notes, cited by the crypto page of the Russian business news website RBC, its primary objective is to provide the required payment infrastructure for the digital ruble. According to the proponents, this would enable Russian citizens, businesses, and the government with access to fast, convenient, and inexpensive money transactions.

People Also Read: Central Bank of Turkey Reports First Payment Transactions on Digital Lira Network

The proposal aims to amend several existing laws such as the law on “On the National Payment System” to which the members of Duma want to add definitions pertaining to the CBDC. The new provisions assign to the Bank of Russia the role of sole operator of the CBDC platform. They also establish the procedures for opening wallets for the digital ruble and accessing its platform.

An amendment to the law “On Currency Regulation and Currency Control” secures the status of the digital ruble as a currency of the Russian Federation and defines CBDCs issued by the central banks of other nations as foreign currencies. Changes to the Federal Law “On Personal Data” allow Russia’s central bank to process personal information without obtaining consent and without the need to notify in advance the Russian authority responsible for protecting the rights of subjects of personal data.

In October 2020, the Central Bank of Russia announced the concept for its digital money, and in December 2021, it completed the prototype platform. In January of this year, the pilot phase commenced. The monetary authority announced in May that tests with real transactions and clients will begin in April 2023. In June, against the backdrop of escalating Western sanctions imposed in response to Moscow’s armed invasion of Ukraine, the regulator announced an acceleration of the project’s launch timeline, targeting 2024. There are currently over a dozen Russian banks and other financial organizations participating in the trials.

READ MORE

Goldman Sachs Boss Unveils Plan To Cut Jobs Amid Global Economy Fears

US Government Delays Tax Reporting Rules for Cryptocurrency Brokers

European Central Bank to Decide Whether to Issue Digital Euro in 2023