BRICS Currencies to Have No Alternative, Former Russian President Medvedev Says – Former Russian President Dmitry Medvedev suggests that the fiat currencies of BRICS countries will become the primary currency in the future, and advises member states to consider developing their digital forms of currency, as well as a digital currency issued by the bloc. Medvedev predicts the possible collapse of the euro and the return to national fiat currencies in Europe, which may result in financial shocks.

His statements were reported by RIA Novosti news agency. According to Medvedev, the euro is becoming less resilient to external factors and is losing its status as a universal payment method. Therefore, it is likely that Europe will return back to “the system of financial patchwork with national currencies. Well, then goodbye euro, hello mark, lira, and French franc,” he added. Dmitry Medvedev, who serves as the Deputy Chairman of the Security Council of the Russian Federation since 2020, was speaking during the “Knowledge First” educational marathon which he was invited to attend.

People Also Read: ECB’s Panetta Reinforces Digital Euro Focus on Payments

He further elaborated: “In this case, the ruble, yuan, Indian rupee, and other currencies of the BRICS countries will have no alternative in the future.” Medvedev underlined the necessity for the BRICS member states to contemplate the digital versions of their respective fiat currencies, along with exploring the prospect of introducing a digital currency issued by the group. “The leaders of our organization are now talking about it,” he noted.

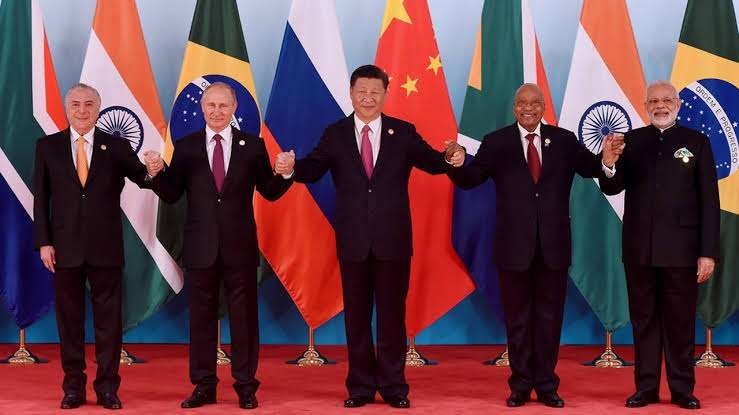

A summit will be held by the BRICS bloc, comprising Brazil, Russia, India, China, and South Africa, in early June in Cape Town, South Africa, to deliberate on several important topics, including enlargement proposals. In late December, Medvedev, the leader of Russia’s ruling United Russia party, predicted that the U.S. dollar would lose its status as the global reserve currency by 2023, citing the rise of digital currencies.

His recent remarks follow this prediction. To mitigate the impact of Western sanctions due to its involvement in Ukraine, Russia has been developing a digital ruble and a payment system that would not limit digital currency transactions. Additionally, Moscow aims to legalize cryptocurrency payments in international settlements as part of its efforts to reduce dependence on the dollar.

READ MORE

Russia Launching Payment System With ‘No Restrictions’

Indonesia Is Following BRICS De-Dollarization Lead, Says Central Bank Governor