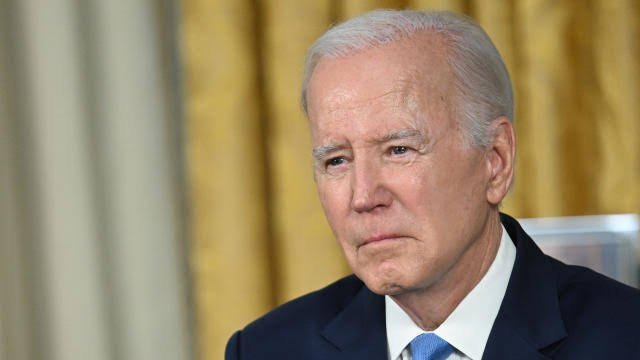

Supreme Court Axes President Biden’s Student Loan Forgiveness Plan – The Biden administration’s proposal to cancel up to $20,000 in student loan debt for American borrowers has been invalidated by the Supreme Court, marking the conclusion of a highly anticipated case. In the case of Biden v. Nebraska, the court’s ruling of 6-3 followed ideological divisions, as the conservative justices held that President Joe Biden and his education secretary do not possess the authority to cancel student loan debt, as that decision lies within the jurisdiction of Congress.

“The question here is not whether something should be done; it is who has the authority to do it,” Chief Justice John Roberts wrote in the opinion of the court. A White House source tells a news outlet that Biden will have more to say about the decision on Friday. “While we strongly disagree with the court, we were prepared for this scenario,” the source says. “The President will make clear he’s not done fighting yet, and will announce new actions to protect student loan borrowers.”

People Also Read: Trump Rails Against Federal Charges

Justice Roberts made an uncommon request in his opinion on Friday, urging Americans not to dismiss the political nature of the Supreme Court’s ruling. “It has become a disturbing feature of some recent opinions to criticize the decisions with which they disagree as going beyond the proper role of the judiciary,” the opinion reads, adding, “our precedent—old and new—requires that Congress speak clearly before a Department Secretary can unilaterally alter large sections of the American economy.”

He continued: “We have employed the traditional tools of judicial decision-making in doing so. Reasonable minds may disagree with our analysis—in fact, at least three do,” referring to the three liberal justices who dissented. In August 2022, Biden unveiled his highly anticipated proposal for student loan forgiveness.

According to the plan, individuals who are not recipients of Pell Grants would have the opportunity to have up to $10,000 in student loan debt forgiven if their annual income is below $125,000. For Pell Grant recipients who meet the same income threshold, they would be eligible for a maximum cancellation of $20,000. Married couples would need to have a combined annual income below $250,000 to qualify for loan forgiveness.

Of the 43 million borrowers who are eligible for the plan, the White House believes “20 million of them will have their debt totally wiped away and about two-thirds of them will have half or more of their debt wiped out,” Kate Berner, White House deputy communications director stated. The student debt relief plan faced swift legal challenges, including a case brought by student loan borrowers who claimed they were unjustly excluded from the loan forgiveness program due to not being recipients of Pell Grants.

People Also Read: Biden to Deliver Major Economic Address in Chicago Next Week

One case resulted in an appeals court affirming a Texas judge’s ruling to halt the implementation of the plan, while another case led to a federal judge issuing an injunction to temporarily suspend the rollout of the loan forgiveness program following lawsuits from six Republican-led states against the Biden administration. In February, the Supreme Court conducted oral arguments for the cases related to student debt cancellation.